Business Licensing in Saudi Arabia

Full licensing support from setup to launch — guided by IfTab.

Everything You Need to Start — With IfTab by Your Side

Setting up a business in Saudi Arabia requires obtaining the appropriate

commercial license aligned with your company’s activity, legal structure, and

ownership model. Whether you are a foreign investor, joint venture, or local

entrepreneur, compliance with regulatory guidelines from authorities such as

the Ministry of Investment (MISA), the Ministry of Commerce, and the relevant

municipal bodies is essential.

The process involves several steps, including securing a foreign investment

license (if applicable), trade name registration, activity classification, Chamber

of Commerce membership, office lease contracts, and approvals from sectorspecific authorities — depending on the nature of your business.

This can often be time-consuming and complex, especially for first-time

entrants unfamiliar with the local legal landscape. That’s where **IfTab steps

in as your trusted partner

How IfTab Makes Licensing Easy

We handle the entire process so you can focus on your business

Initial Consultation & Business Activity Mapping

We help you choose the right license based on your goals.

Complete Documentation Support

From trade name registration to legal forms — we take care of it all.

Government Liaison & Approvals

We coordinate with MISA, MC, ZATCA, and other authorities to ensure smooth approvals.

Foreign Ownership Advisory

Full or partial foreign ownership? We help you stay compliant.

Local Sponsorship (if required)

Reliable local partnerships when needed for specific licenses.

Post-License Services

We assist with permits, visas, Chamber registration, and office setup.

Key Benefits of Saudi Business Licensing

- Legal Authorization to operate and conduct business activities within Saudi Arabia.

- Enhanced Credibility with customers, partners, government entities, and investors.

- Access to Banking Services, including opening corporate accounts and applying for financing.

- Eligibility for Foreign Ownership (up to 100%) in many sectors under Vision 2030 reforms.

- Ability to Sign Contracts, bid on government tenders, and enter into formal agreements.

- Streamlined Visa Processing for hiring foreign employees and sponsoring staff.

- Access to Giga-Projects like NEOM, Red Sea Development, and other special economic zones.

- Participation in Incentive Programs, subsidies, and sector-specific growth initiatives.

- Tax and Regulatory Benefits aligned with national investment goals.

- Foundation for Long-Term Growth and expansion in a strategically located, fast-growing market.

Types of Business Licenses in Saudi Arabia

1. Commercial License

Requirments

- Minimum Capital: Generally SAR 10,000 to SAR 500,000, depending on the type of commercial activity.

- Location: Can be applied to any location across Saudi Arabia, but must comply with local zoning laws.

- Documents: Trade name registration, Chamber of Commerce membership, Lease agreement for office or business premises, Commercial Registration (CR), National Address registration.

Key Points

This license is required for retail, wholesale, or service businesses and is the most common type of license for general commercial activities.

2. Industrial License

Requirments

- Minimum Capital: SAR 25,000 (for small-scale industries), but it can be higher for large-scale industries.

- Location: Must be located in industrial zones or areas approved by the Saudi Arabian General Investment Authority (SAGIA). These zones are often located in major industrial areas such as Riyadh, Jeddah, and Dammam.

- Documents: Company established outside KSA for at least 1 year, Certified commercial registration from the Saudi Embassy, Certified financial statements (previous year), Feasibility study for the industrial project, Environmental clearance from Ministry of Environment, Industrial site lease agreement, Proof of capital investment.

Key Points

Industrial licenses are issued for manufacturing and production activities, with preference given to projects that support the Vision 2030 economic goals.

3. Professional/Service License

Requirments

- Minimum Capital: SAR 50,000 to SAR 500,000, depending on the type of service provided.

- Location: Can be applied for in all cities, but businesses involving technical services may need to be located in areas with a specific demand for such services (e.g., IT companies in Riyadh, consulting in Jeddah).

- Documents: Academic/professional qualifications of the owner or key staff, MISA approval (for foreign companies), Office lease agreement, Chamber of Commerce registration, National Address registration.

Key Points

Required for businesses offering specialized services such as consulting, engineering, healthcare, IT, and legal services.

4. Foreign Investment License (MISA License)

Requirments

- Minimum Capital: Varies based on the sector (typically SAR 500,000 or higher for most foreign investments).

- Location: * Investment must be in an area that supports foreign investment, including Riyadh, Jeddah, Dammam, and other major economic zones.

- Documents: Legal establishment outside Saudi Arabia, MISA approval, Detailed business plan, Certified financial statements (parent company), Lease agreement for office space, Capital investment proof.

Key Points

Foreign investors can fully own businesses in sectors approved by the Ministry of Investment (MISA) under the Saudi Foreign Investment Act.

5. Real Estate License

Requirments

- Minimum Capital: * Must operate in cities with high real estate activity such as Riyadh, Jeddah, Dammam, Mecca, and Medina. Real estate activities can be focused on development, sales, leasing, or management.

- Location: * Investment must be in an area that supports foreign investment, including Riyadh, Jeddah, Dammam, and other major economic zones.

- Documents: CR and Chamber registration, Real estate activity classification, MISA approval for foreign entities, Proof of capital investment, Lease or ownership agreement for properties to be managed or developed.

Key Points

Real estate licenses allow for the development, sale, leasing, and management of properties, with emphasis on projects that support the Saudi Vision 2030.

6. Tourism License

Requirments

- Minimum Capital: Minimum Capital:** SAR 100,000 or more, depending on the scope of tourism activities (tour operators, travel agencies, hotels, etc.).

- Location: Can be applied in tourism-heavy areas such as Mecca, Medina, Riyadh, Jeddah, and the Red Sea coast.

- Documents: CR and Chamber registration, Ministry of Tourism approval, Safety and quality compliance certificates, Office lease agreement, Feasibility study for tourism business

Key Points

The tourism sector is crucial to Vision 2030, with increased demand for hospitality, travel agencies, and related services.

7. Mining License

Requirments

- Minimum Capital: Varies based on the scale of the mining operation, with initial investments starting from SAR 1,000,000.

- Location: Mining activities must be located in designated mining zones such as those near Ma'aden or specific areas in the Northern and Western parts of Saudi Arabia.

- Documents: Geological survey of mining site, Environmental clearance from Ministry of Environment, Feasibility study for mining activities, Mining site lease agreement, Capital investment proof.

Key Points

Mining licenses allow exploration and extraction of minerals and are key to the development of the Saudi economy, especially under Vision 2030’s focus on mining and industrial sectors.

8. Agricultural License

Requirments

- Minimum Capital: Varies; typically starting from SAR 100,000 depending on the scope of agricultural activity.

- Location: Must be located in agricultural zones, particularly in the central and western regions of Saudi Arabia (e.g., Al Qassim, Jeddah, and southern regions).

- Documents: Approval from the Ministry of Environment, Water & Agriculture, Lease or ownership agreement for agricultural land, Feasibility study, National address registration.

Key Points

Agricultural activities are a vital part of Saudi Arabia’s Vision 2030 to diversify its economy and reduce dependence on oil.

9. Media & Advertising License

Requirments

- Minimum Capital: Typically starting from SAR 50,000 for small-scale media ventures, and can go higher for large media companies.

- Location: Can be based anywhere, but major media hubs such as Riyadh and Jeddah are the primary locations for media businesses.

- Documents: CR and Chamber registration, Approval from the General Commission for Audiovisual Media (GCAM), Office lease agreement, Portfolio or work samples (for content-related businesses).

Key Points

Required for businesses involved in media production, advertising, and content distribution.

10. Freelancer License (Freelance Visa)

Requirments

- Minimum Capital: No capital requirement.

- Location: Can operate from anywhere in Saudi Arabia.

- Documents: Proof of qualification (degree, portfolio, etc.), Registration via Ministry of Human Resources freelance portal, National address registration

Key Points

Freelancer licenses allow individuals to operate as self-employed professionals in sectors like IT, media, design, and education.

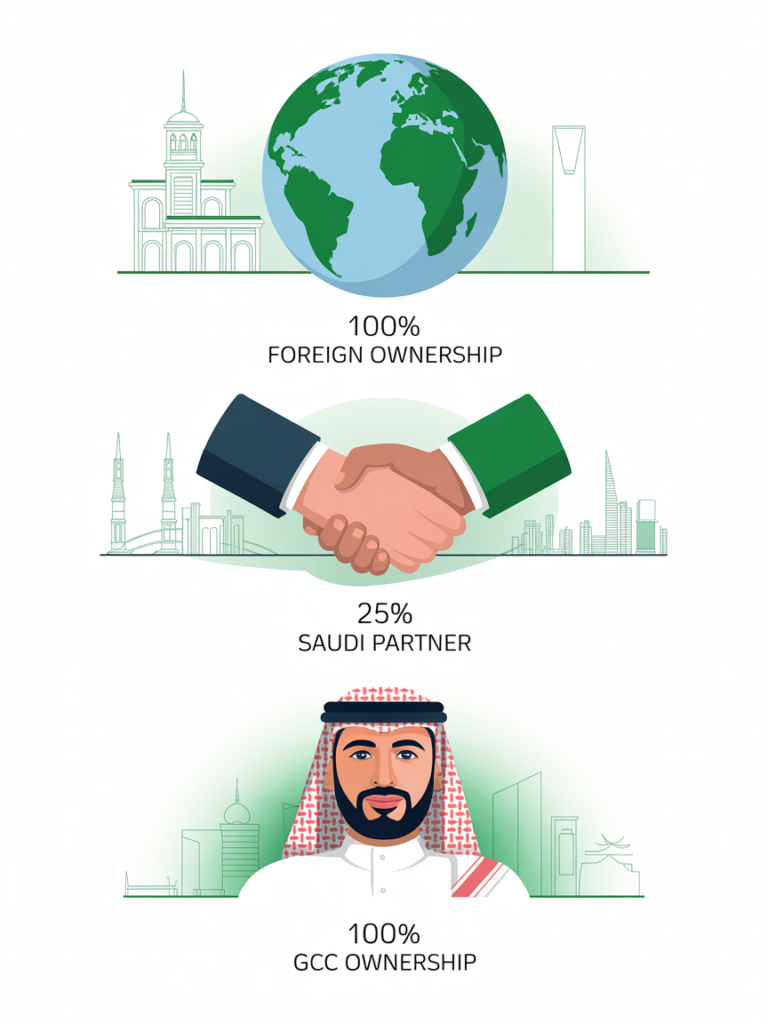

Ownership Models & Requirements in Saudi Arabia

Understanding your ownership options is key to setting up your business in Saudi Arabia. Whether you are a foreign investor, partnering with a Saudi national, or a GCC citizen — here’s what you need to know:

100% Foreign Ownership

Ideal for: International investors and foreign companies expanding into Saudi Arabia.

Requirments

- Minimum Capital: SAR 500,000+ (varies by sector)SAR 500,000, depending on the type of commercial activity.

- Location: Must invest in economic zones or designated cities like Riyadh, Jeddah, or Dammam.

- Documents: Legal establishment outside Saudi Arabia, MISA approval, Business plan, Certified financial statements, Office lease agreement

Foreign Investor with 25% Saudi Partner

Ideal for: Joint ventures looking for local insight and broader operational flexibility.

Requirments

- Minimum Capital: SAR 500,000+ (varies by sector)

- Location: Anywhere in Saudi Arabia, with preference for economic hubs.

- Documents: Formal partnership agreement, Commercial Registration (CR), Chamber of Commerce registration, MISA approval (if required), Business plan, Proof of capital investment.

100% GCC-National Owned Companies

Requirments

- Minimum Capital: SAR 100,000+ (depending on sector)

- Location: Anywhere in Saudi Arabia (sector-dependent)

- Documents: Documents Needed: Formal partnership agreement, Commercial Registration (CR), Chamber of Commerce registration, MISA approval (if required), Business plan, Proof of capital investment.

Step-by-Step Business License & Registration Process

Powered by IfTab – Your Strategic Partner in Business Expansion

Setting up a company in Saudi Arabia involves several coordinated steps — and IfTab makes the journey seamless from start to launch. Here’s how we guide you every step of the way:

Define Your Business Activity & Legal Structure

Determine your business type (commercial, industrial, or services) and choose the right legal entity (LLC, Joint Venture, Sole Proprietorship, etc.).

- IfTab helps assess the best structure based on your goals and compliance needs.

Reserve a Trade Name

Submit your preferred name to the Ministry of Commerce (MoC) for approval.

- IfTab ensures it aligns with regulations and handles reservation swiftly.

Apply for Foreign Investment License (if required)

Foreign investors must obtain a license from MISA.

- IfTab prepares and submits all documentation, including company profiles and shareholder details.

Draft & Notarize Articles of Association

Legally define your internal operations and ownership model.

- IfTab provides legal drafting, translation, and notarization services.

Register with Ministry of Commerce (MoC)

Obtain your Commercial Registration (CR) to legally form the company.

- IfTab manages the full registration process for timely approval.

Open a Corporate Bank Account

Deposit share capital and obtain a bank certificate.

- IfTab connects you with banks and ensures all requirements are met.

Register with Chamber of Commerce

A mandatory step after receiving your CR.

- IfTab handles enrollment and offers compliance guidance.

Secure Municipality (Baladiya) License

Get your physical office inspected and zoning verified.

- IfTab works directly with municipal authorities to ensure compliance.

Register with ZATCA (Tax Authority)

Enroll for VAT, zakat, or corporate tax as applicable.

- IfTab takes care of tax registration and ongoing accounting support.

Register with GOSI (Social Insurance)

Required for hiring Saudi or expat staff.

- IfTab facilitates employer registration and payroll reporting setup.

Obtain Sector-Specific Licenses

Some businesses may need additional approvals (e.g., Tourism, Health, Media).

- IfTab secures all necessary sectoral clearances.

Launch Your Business

You’re ready to operate!

- IfTab continues supporting you with PRO/GRO services, HR, finance, and compliance.

Why Partner with IfTab?

IfTab is more than a facilitator—we are your strategic ally in business

incorporation and expansion. With deep local insights, legal expertise, and end-to-end support, we make your Saudi market entry smooth, compliant, and efficient.